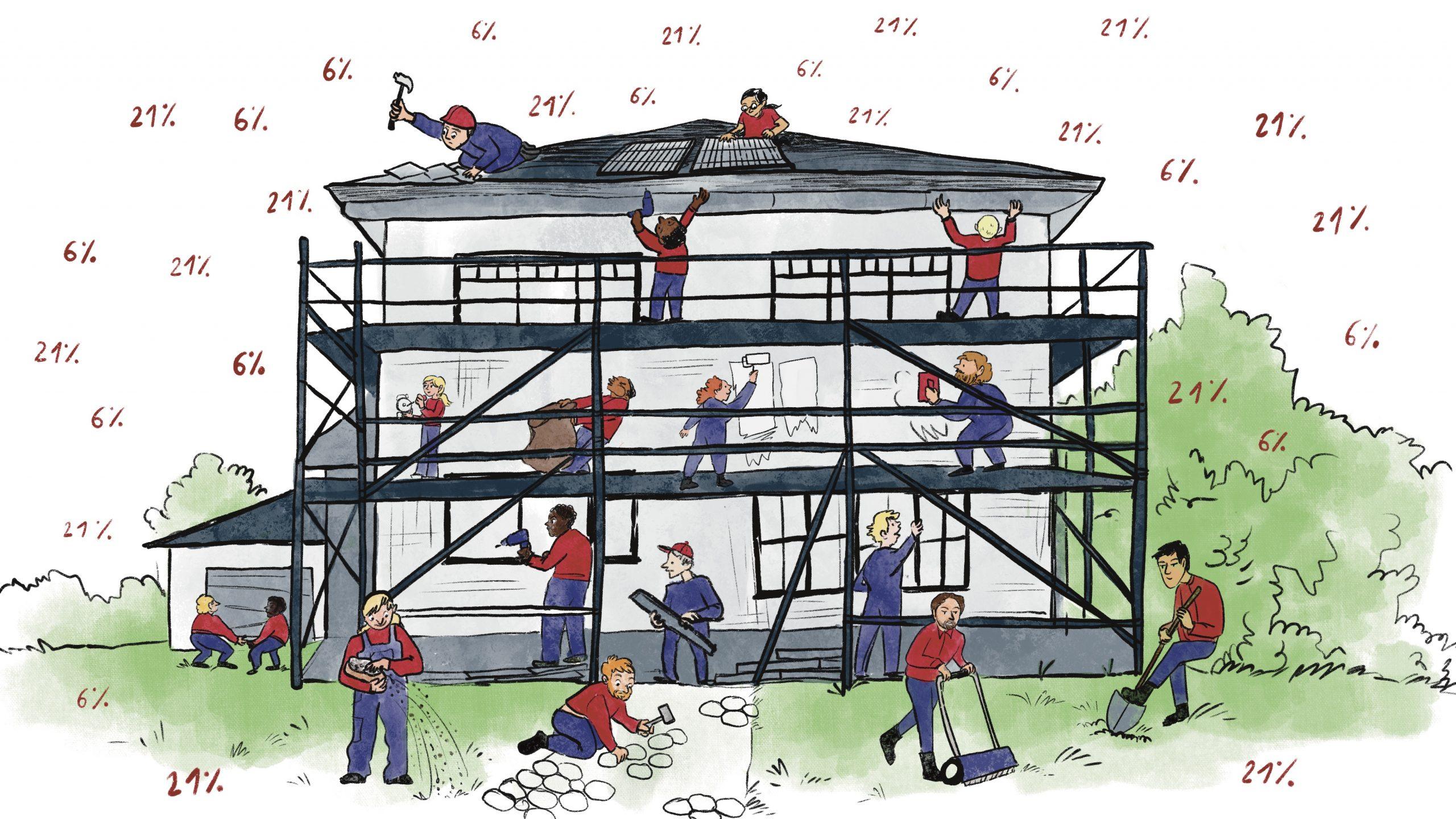

VAT: Demolition/Reconstruction: Deal kept?

In order to avoid contradicting rules in our country's various regions, the federal government had announced in its coalition agreement that it was essential that projects carried out by professionals could also be marketed at the reduced VAT rate of 6% for demolition and reconstruction.

The reduced rate of 6% was to apply to everyone!

As a result, current social conditions would be maintained, and the surface criterion would be tightened from 200m2 to 175m2 for delivery.

The draft program law mentions the following different situations:

- For the principal – individual, the conditions for obtaining the scheme will be (unless amended):

- After completion of the work:

- The principal-individual uses the building as the sole and principal owner occupied dwelling and establishes its domicile there ;

- The living surface area is maximum 200m2 ;

- Electronic declaration to the Minister of Finance (+ copy to service providers):

- The planning permission; and

- The building contracts;

- Tax due no later than 31/12 of the year of first occupation;

- Invoices issued by the service providers must mention the elements justifying the application of the reduced rate, to release the service providers from their liability.

- Invoices issued by the service providers must mention the elements justifying the application of the reduced rate, to release the service providers from their liability.

- Invoices issued by the service providers must mention the elements justifying the application of the reduced rate, to release the service providers from their liability.

- After completion of the work:

- The reduced rate will still be applied to current social benefits (long-term social rental).

- For the principal – legal entity – the conditions for obtaining the scheme will be (unless amended):

- Demolition-reconstruction of a building located on the same cadastral parcel;

- Tax liability from June 1, 2025;

- Destination:

- for own and sole habitation of an individual whose living area is maximum 175m2

- for long-term social rental

- for long-term rental to an individual whose living area is maximum 200m2

- Electronic declaration before the time when the tax becomes due or in the case of sale on plan before the time when the taxable event occurs by attaching (+ in case of co-contractor – copy given):

- the planning permission

- the building contracts

- the private agreement or notarial deed.

- Invoices issued by service providers must mention the elements justifying the application of the reduced rate, to release the service providers from their liability.

- For long-term rental, the following conditions must be met:

- After completion of the work:

- Use as the sole and principal dwelling of the individual owner;

- Living surface area of maximum 200m2 ;

- Electronic declaration to the Minister of Finance appended (+ copy to service providers):

- the planning permission; and

- the building contract;

- Tax due no later than 31/12 of the year of first occupancy;

- Invoices issued by service providers must mention the elements justifying the application of the reduced rate to release the service providers from their liability.

- After completion of the work:

This is good news for property developers, although the difference in surface area maybe discriminatory and unfounded. In addition to using controversial criteria, the differences in figures are meaningless.

Discover more about this topic?

I am looking for a specialist in

See more articles

19.01.2026

We are pleased to announce several important developments that will further strengthen Andersen in Belgium’s M&A and commercial law capabilities as of January 2026.

First, we are pleased to announce that the West Flanders team of Philippe & Partners has joined Andersen in Belgium. Based in Roeselare, the team is led by Partner Dirk Clarysse, together with Charlotte Romaen, Senior Counsel.

14.01.2026

Court of Cassation confirms the personal disciplinary liability of each individual real estate agent, including those operating within a real estate group

By judgment of 18 December 2025, the Belgian Court of Cassation delivered a significant ruling in a disciplinary (disciplinary law / professional disciplinary proceedings) case against a real estate agent, with far-reaching consequences for the real estate profession.

13.01.2026

Construction Law & Liability of the Architect

In an important judgment of 19 December 2025 (C.25.0192.F), the Court of Cassation emphasized the fundamental importance of the architect’s duty of supervision when selecting the contractor, in particular with regard to the contractor’s access to the profession.

13.01.2026

Autonomous guarantee finally enshrined in law

With Book 9 of the Civil Code, the autonomous guarantee - also known as a bank guarantee or guarantee on first demand - now has, for the first time, a clear statutory basis in Belgium. Until now, this legal instrument was primarily shaped by case law, customary practice, and international soft law. With regard to the latter, reference is often made to the so-called URDG 758 (Uniform Rules for Demand Guarantees), a set of practical rules drawn up by the International Chamber of Commerce (ICC). These rules are not binding as such, but they are frequently used in (inter)national trade because they provide uniform and recognizable arrangements and thus legal certainty.