Tax challenges for cryptocurrency investors

What are the potential risks faced by cryptocurrency holders under current tax legislation and in light of the future taxation of capital gains on financial assets?

Under current Belgian tax legislation, capital gains realised by individuals on cryptocurrencies may either be exempt as part of the normal management of private wealth, taxed as miscellaneous income at a separate rate of 33%, or – in cases of a regular and organised activity – taxed as professional income at progressive rates.

Recent practice by the Ruling Commission has refined the relevant factual criteria (amount invested, frequency of transactions, use of leverage, automation, taxpayer’s professional activity, etc.), resulting in either exemption or taxation as miscellaneous income depending on the case.

In the short term, the tax authorities’ control will be strengthened through expanded access to the Central Point of Contact and through future reporting obligations by cryptocurrency trading and exchange platforms, as provided by the 8th Directive on Administrative Cooperation (DAC 8) from 2026 onwards.

In the medium term, a draft bill introduces, as from 1 January 2026, a new 10% tax on capital gains on crypto-assets realised within the framework of normal asset management, while maintaining the 33% rate for speculative gains. The capital gain accumulated up to 31 December 2025 will in principle be exempt from the new 10% tax.

In addition, certain types of income linked to crypto-assets – such as “staking” (the process of locking up cryptocurrency to support a blockchain network and earn rewards in return) – are treated as income from movable property.

Finally, advance rulings have a limited validity period and contain reservations in the event of imminent legislative reform.

Current qualification of gains: exemption, miscellaneous income (Article 90, 1°, ITC 92) or professional income (Article 23, § 1, ITC 92)

Pursuant to Article 90, paragraph 1, 1° of the Income Tax Code 1992 (ITC 92), gains arising from operations or speculation outside a professional activity are deemed miscellaneous income, unless they fall within the scope of normal management of private wealth, in which case they are not taxable.

If the activity exceeds those limits and displays a professional nature within the meaning of Article 23, § 1, ITC 92 and Com. IR 92 no. 23/35 (see Cassation 1968 and 1969), taxation applies as professional income.

Administrative doctrine recalls that, in the absence of a specific regime, general provisions apply: the tax administration examines on a case-by-case basis whether the operations fall under normal asset management and applies a 33% separate tax rate if the income is considered miscellaneous.

The personal income tax instructions for 2026 confirm this tripartite structure:

- Exemption for normal management of private wealth;

- 33% rate for speculative activity (Article 171, 1°, ITC 92);

- Progressive rates if qualified as professional income.

Recent advance rulings present and apply these criteria — both to exclude professional character and to confirm or reject qualification as miscellaneous income.

For example, 2025 rulings exclude taxation (the income being neither professional nor miscellaneous) when the facts show a cautious, non-automated investment strategy, while a ruling of 19 August 2025 qualifies income as miscellaneous due to a relatively large investment and a high volume of transactions.

Factual criteria identified by the SDA and risk of requalification

The questionnaires of the Ruling service and ruling practice identify several key factors: the origin of the crypto-assets, the age of the portfolio, the amount and share of wealth invested, frequency of transactions, “buy and hold” strategy, the taxpayer’s profession, use of borrowing, automation of operations, mining (mining) activity, presence on forums, investments for third parties, and the use of advisers.

Several rulings (2018 – 2025) conclude that exemption applies where the crypto-assets were acquired with own funds, without mining (mining being the fundamental activity that maintains cryptocurrency networks such as Bitcoin). Mining validates transactions, groups them into blocks, and secures the network in a decentralised way. Exemption generally applies where there is no automation, investment represents a limited share of the assets, and a long-term holding strategy is pursued.

Conversely, investing more than half of one’s movable wealth or engaging in a high volume of transactions leads to taxation as miscellaneous income.

The Ruling Service generally limits rulings to one year and includes explicit reservations in case of substantial amendments to the ITC 92, exposing holders to a risk of review if circumstances change or the law is amended.

The ruling of 19 August 2025 illustrates reclassification as miscellaneous income in the presence of a relatively large investment and numerous transactions, without, however, recognising a professional nature.

In 2024 communications, the Ruling Service confirmed that both the proportion of the portfolio dedicated to cryptocurrencies and the frequency of operations weigh heavily in its analysis.

Developments 2025–2026: strengthened control, DAC 8 and forthcoming 10% tax

The government agreement announces broader access for the tax authorities to the Central Point of Contact and the mandatory notification of cryptocurrency accounts to that register, along with an enhanced data-mining framework.

Combined with DAC 8 (crypto-CRS), applicable as from 1 January 2026, the anonymity of cryptocurrency holders will be significantly reduced, increasing the risk of detection and audit.

A draft law of July 2025 (the forthcoming tax on capital gains realised by individuals and legal persons other than companies on their financial assets) further provides that, as from 1 January 2026, capital gains on crypto-assets qualifying as normal management of private wealth will be subject to a new 10% tax, with exemption for gains accumulated up to 31 December 2025.

In contrast, speculative or professional capital gains will continue to be taxed as miscellaneous income at 33%, or at progressive rates for professional income, without any reset for historical gains.

Several advance rulings of 2025 draw attention to potential significant amendments to the ITC 92 that may affect their validity.

Meanwhile, an ruling of the Ruling Service (March 2025) classifies staking rewards (staking consists of locking a cryptocurrency to support the security and functionality of a blockchain in exchange for rewards) as income from movable property (Article 17, § 1, ITC 92), akin to interest (Article 19, 1°, ITC 92), implying a separate reporting obligation from that applicable to capital gains.

In practice, investors are thus exposed to a dual taxation framework:

- the new 10% contribution for normal management, and

- the 33% tax in case of speculation, progressive rates for professional income, and – for certain flows such as staking – taxation as movable income.

There is little doubt that investors in such financial products will need to adapt their investment and portfolio management strategies in response to this major change, which amounts to a true tax revolution.

Thierry LITANNIE

Tax Partner, Andersen

Discover more about this topic?

I am looking for a specialist in

See more articles

07.11.2025

•Urban Planning and Environmental Law

No financial charges may be imposed in an environmental permit without an urban planning regulation.

The Council for Permit Disputes (RvVb) annulled, on 9 October 2025, a financial charge imposed in a decision granting an environmental permit. Such a charge may, since 2024, only be imposed on the basis of an urban planning regulation within the meaning of Articles 2.3.1 and 2.3.2 of the Flemish Code for Spatial Planning (VCRO). Prior to the amendment of the Decree, the Environmental Permit Decree did provide that such a financial charge could be imposed by the permitting authority and under what conditions, but it was not required that a regulation be included in an urban planning ordinance.

06.11.2025

•Administrative Law and Public Procurement

Proposed decree: EIA screening transferred to higher government

Local authorities face a dilemma: they want to invest in public construction projects, but are no longer allowed to assess their own projects when these have a significant impact on the environment. A new draft decree aims to break the deadlock, but at the same time raises questions about how independent the assessment will really be when it is simply shifted to another political level.

04.11.2025

•Administrative Law and Public Procurement

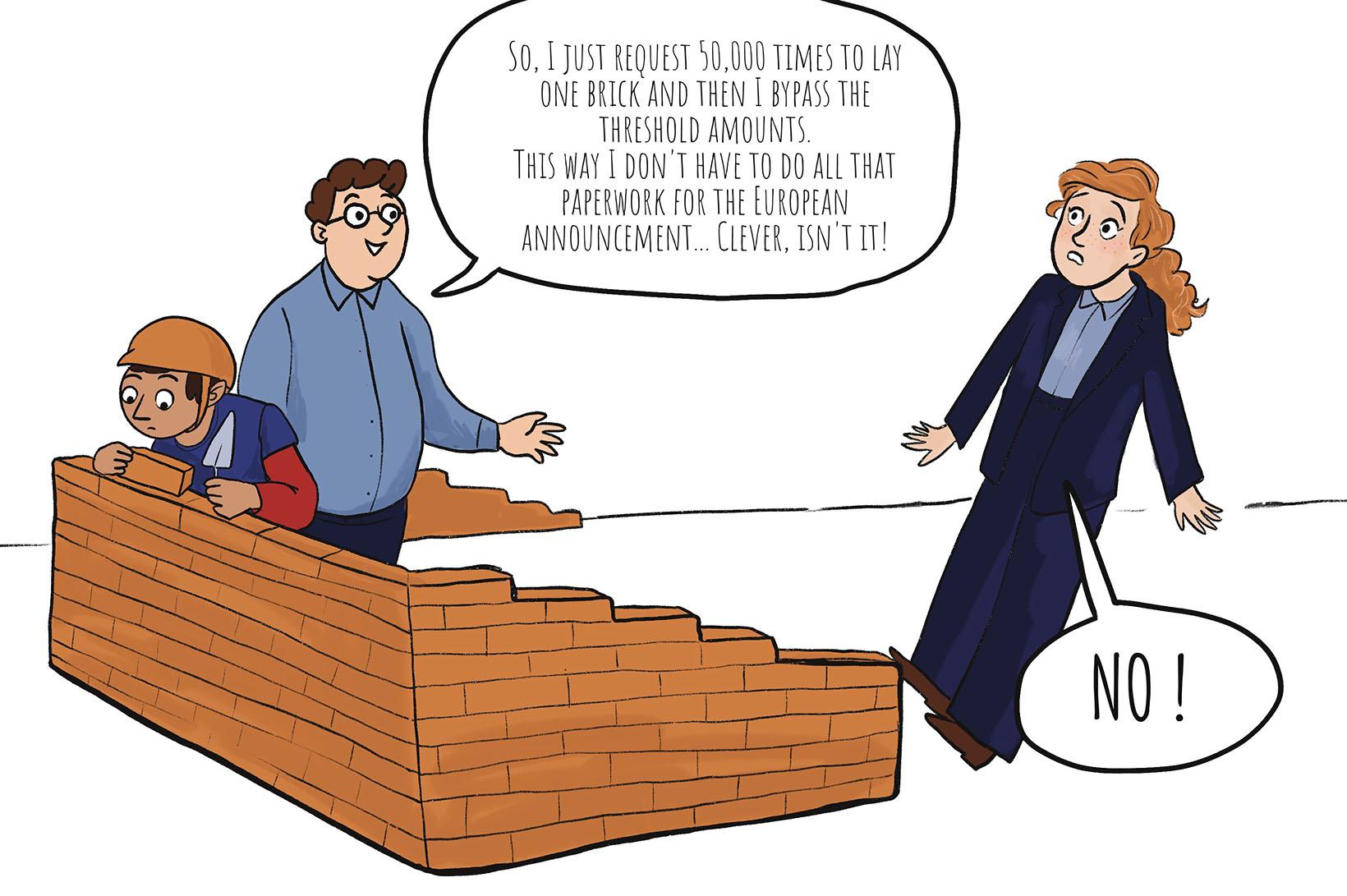

Tightening of public procurement regulations following new European threshold amounts from January 1, 2026

On October 23, 2025, the new European threshold amounts that tighten public procurement regulations were published in the European Official Journal. When awarding public procurements, the contracting authority must take into account a number of threshold amounts.

22.10.2025

•Urban Planning and Environmental Law

Reconstruction of destroyed or damaged non-zoned dwelling: No time pressure without a clear insurance amount

The Council for Permit Disputes (RvVb) recently overturned a decision by the province of East Flanders to refuse an environmental permit for the reconstruction of a burned-down, non-zone-compliant dwelling. The RvVB ruled that the period within which the application for such a permit must be submitted only begins once there is certainty about the amount of insurance granted.