Reconstruction of destroyed or damaged non-zoned dwelling: No time pressure without a clear insurance amount

The Council for Permit Disputes (RvVb) recently overturned a decision by the province of East Flanders to refuse an environmental permit for the reconstruction of a burned-down, non-zone-compliant dwelling. The RvVB ruled that the period within which the application for such a permit must be submitted only begins once there is certainty about the amount of insurance granted.

Judgment of the Council for Permit Disputes of September 18, 2025, no. RvVb-A-2526-0037.

What was the issue?

The owner of a house lost his home after a fire in 2016. This house was not zoned for residential use, as it was located in an agricultural area, a zone where residential construction is generally not permitted. The owner wanted to build a new house on the same site and submitted several permit applications, which were all rejected.

The last application was dated 2023 and was rejected by the province because it was submitted too late. According to the province, the application had to be submitted within three years of the insurance amount being awarded, as stipulated in Article 4.4.21 of the Flemish Spatial Planning Code (VCRO).

The province based its decision on a letter from the fire insurer dated 2017, in which a specific insurance amount was awarded to the applicant. According to the province, the three-year period began at that time, which meant that the 2023 application was too late.

The owner disagreed with this, arguing, among other things, that there was a dispute between him and the insurer about the insurance amount. This dispute has since been brought before the civil court, so that the insurance amount already awarded may still change.

What did the Council for Permit Disputes decide?

The Council specified that the three-year period only starts to run from the moment the owner has certainty about the full insurance amount. Because the owner and his insurer disagreed from the outset about the calculation of the fire damage and also submitted this dispute to the civil court, the Council found that there was still no clarity about the final insurance amount.

According to the Council, the province had therefore wrongly ruled that the application had been submitted too late. The Council consequently overturned the refusal of the permit application and obliged the province to take a new decision.

Why is this ruling important?

This ruling clarifies how the three-year period referred to in Article 4.4.21 of the VCRO should be interpreted. As long as there is a genuine dispute about the full insurance amount, the administration cannot simply declare that the deadline for submitting a claim has expired.

On the one hand, this decision offers hope to owners of non-zoned homes that have been destroyed by force majeure and who are at risk of losing out due to lengthy insurance procedures. On the other hand, these owners can now also rely on this to extend the three-year period as much as possible.

Conclusion

The Council confirms that the provision in Article 4.4.21 VCRO is intended to protect owners of non-compliant homes against misfortune and force majeure.

Anyone in a similar situation would be well advised to seek legal advice in good time: the interpretation of the terms and conditions in Article 4.4.21 VCRO remains complex, but can be decisive in determining whether or not a permit can be obtained in cases of force majeure.

Please do not hesitate to contact Andersen’s real estate team in Belgium for more information and assistance in similar cases and proceedings before the Council for Permit Disputes.

Matias Osorio Olivera

Counsel

Discover more about this topic?

I am looking for a specialist in

See more articles

07.11.2025

•Urban Planning and Environmental Law

No financial charges may be imposed in an environmental permit without an urban planning regulation.

The Council for Permit Disputes (RvVb) annulled, on 9 October 2025, a financial charge imposed in a decision granting an environmental permit. Such a charge may, since 2024, only be imposed on the basis of an urban planning regulation within the meaning of Articles 2.3.1 and 2.3.2 of the Flemish Code for Spatial Planning (VCRO). Prior to the amendment of the Decree, the Environmental Permit Decree did provide that such a financial charge could be imposed by the permitting authority and under what conditions, but it was not required that a regulation be included in an urban planning ordinance.

06.11.2025

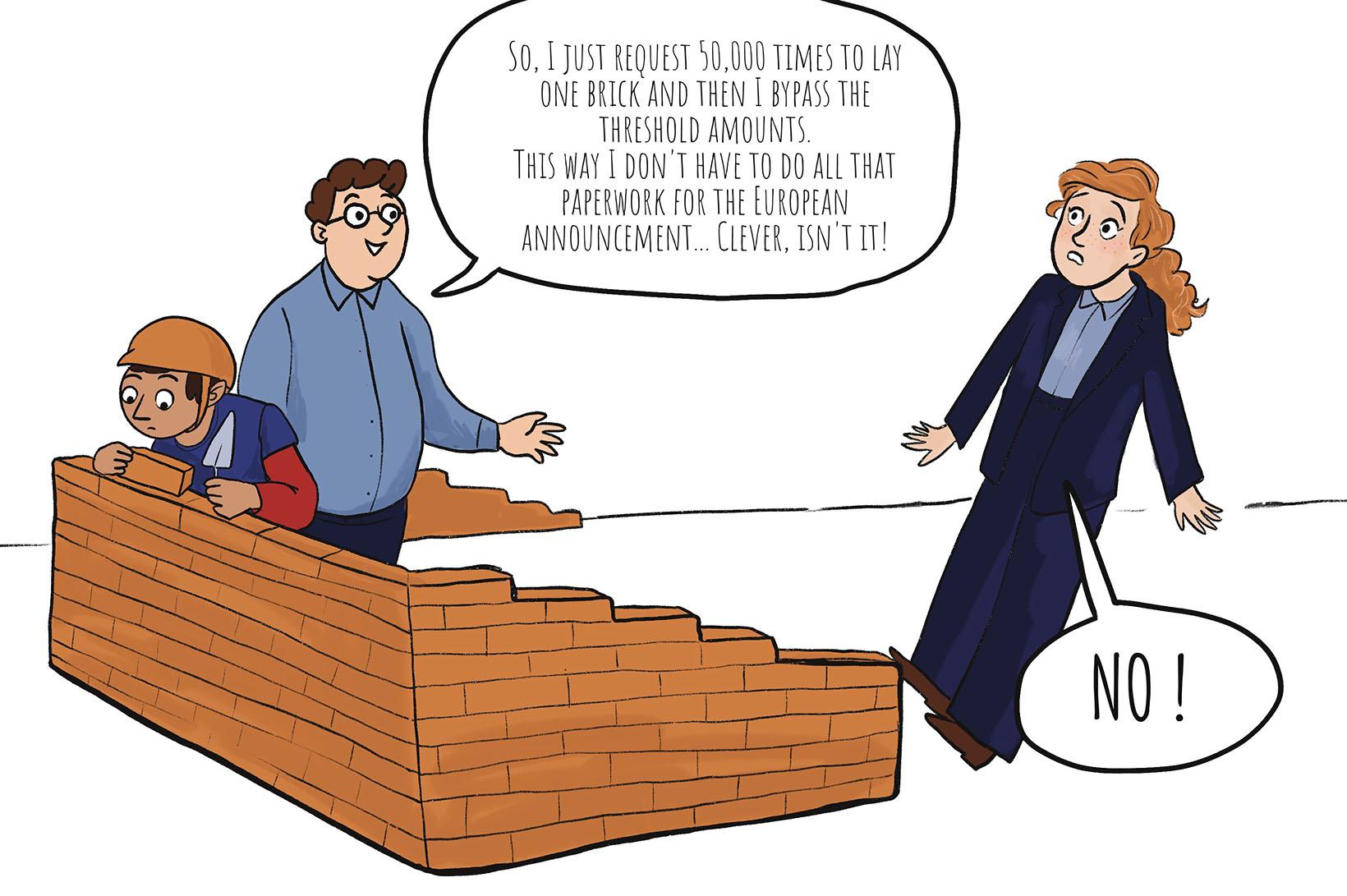

•Administrative Law and Public Procurement

Proposed decree: EIA screening transferred to higher government

Local authorities face a dilemma: they want to invest in public construction projects, but are no longer allowed to assess their own projects when these have a significant impact on the environment. A new draft decree aims to break the deadlock, but at the same time raises questions about how independent the assessment will really be when it is simply shifted to another political level.

04.11.2025

•Administrative Law and Public Procurement

Tightening of public procurement regulations following new European threshold amounts from January 1, 2026

On October 23, 2025, the new European threshold amounts that tighten public procurement regulations were published in the European Official Journal. When awarding public procurements, the contracting authority must take into account a number of threshold amounts.

29.10.2025

•Tax Law

Tax challenges for cryptocurrency investors

What are the potential risks faced by cryptocurrency holders under current tax legislation and in light of the future taxation of capital gains on financial assets?